The Simplicity of Getting the Best Home Equity Loan in Singapore

To understand home equity loans, let us first know what is meant by home equity. Some say that home equity is the best thing that a homeowner has. Sure, having a home is one thing, but being “compensated” for the value of your home in a sense is another feeling of relief at least for most people out there.

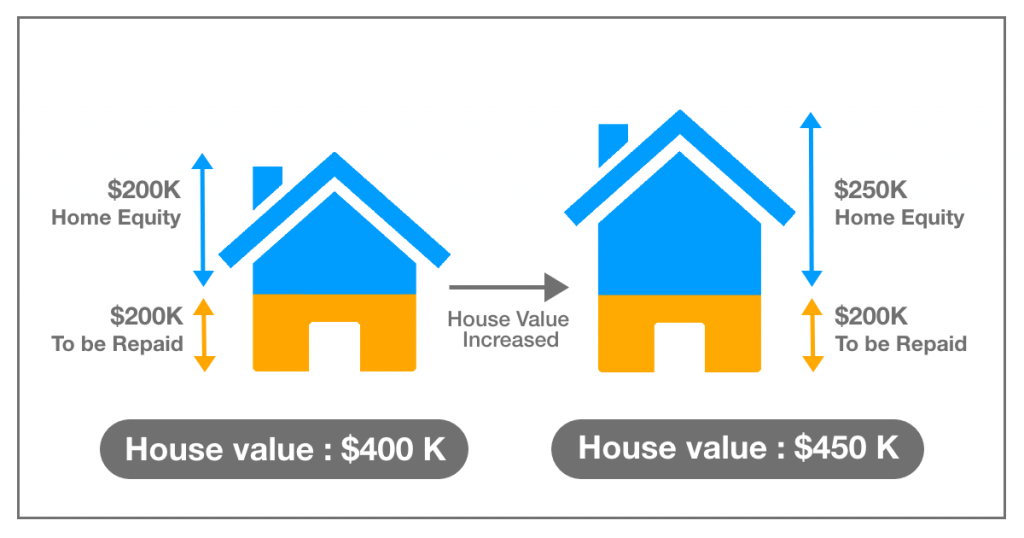

Still, most people don’t know how home equity works. In a nutshell, home equity is the term used for the difference between the current property value of your home and your outstanding mortgage balance. That’s right; you can only gain home equities from mortgages.

Thus, we can loan from this value to pay off something that is used to improve your homes and such.

How to use your home equity loan wisely?

It is with a quick note that home equity does not simply increase. We, as responsible human beings, must pay on time for our mortgages. Once you pay off your mortgage, you increase the home equity value of your house.

Think of it as your paid balance, except this one is variable due to property value hikes and other manmade advances such as home improvements.

Because of this, people can get ridiculously high home equity loans if they’re really good payers. Lenders tend to lend money to those who deserve it after all.

Let’s understand home equity loans with an example:

I know you’re still confused, but to visualize, if your home value is $400,000, and you still have an outstanding mortgage balance of let’s say $200,000, your home equity amounts to $200,000. Of course, property values may shift, so if this property that we’re talking about increases to $450,000, then you’ll have a home equity of $250,000.

This also means that you can effectively loan $250,000 if we’re talking about the latter situation. This is what a home equity loan is all about.

How to increase your home equity?

Simply put, to increase your home equity and your home equity loan, you can depend on property value shifts, or do home renovations to increase your home value a bit. One is a work of nature, and one is a work of man. Either way can increase the value of your properties and eventually, your home equity as well.

What other factors does home equity depend on?

Still, it is not as simple as that. Home equity loans are varied from bank to bank. It also depends on the lenders and such. Interest rates highly vary, and you can be lost at the amount of research that you’ll be pouring into this ordeal.

Also, we must also keep in mind that your home is the collateral in this type of arrangement. Simply put, if you can’t keep up with the payments, your properties can be taken away from you, so don’t make any risky actions with this type of loan!

How to get a home equity loan?

As such, Home Loan Whiz is your most reliable online consultant when it comes to matters like this. We will get you the best fixed rate home equity loans in Singapore so that you can use the extra money to boost your investment portfolios! Home Loan Whiz will bring you to the best and lowest interest rates possible with contrasting options from all the leading banks found in Singapore.

If you wish to inquire, you can do so by going to this link and reading about all their perks when it comes to finding you the best home loan options out there. It’s free and you won’t have to go through the hassle of finding the best home equity loan options, thereby saving you some precious time.

If you’re unsure, Home Loan Whiz has already helped at least 3,500 Singaporeans in getting the best deals for their homes. Upgrade your life now with the best home equity loans straight from the experts in home loan options – Home Loan Whiz!

Click here for a FREE Home Equity Loan Consultation.