Best Floating Rate Home Loan

The first and foremost thing to decide on before buying a property is home loan. And to figure out what type of home loan suits the best. In Singapore, there are basically two major types of home loans: Fixed rate home loan and floating rate home loan.

There are more than 25 banks and financial institutions dealing with home loans in Singapore. All of them provide home loans at competitive prices and try to convince you to take a loan from them. Before moving ahead, you should know which type of loan works best for you and its benefits.

Fixed rate home loan

Fixed rate home loan in Singapore means that the interest rate on your home loan will be fixed for a period of 2-3 years. After that, it is converted into SIBOR or FDR that is set by the banks. That may be equal or higher than the floating rate. The lock in period matches the period of fixed rate of interest.

Floating rate home loan

A floating home loan rate involves regular variation, the frequency of which depends on your floating home loan. The monthly instalment for the same may change with the change in the interest rate.

In Singapore, the floating home loan rate can be a SIBOR(State Bank Interbank Offered Rate) or a FDR(Fixed Deposit Based Rate). The lock in period is typically 2 years, but during this period the rules are relaxed on a partial payment basis.

SIBOR home loan

SIBOR home loan is a floating home loan rate. This is a rate set by a panel of 20 banks in Singapore at which the banks lend money to each other. And this is done by the Association of Banks in Singapore daily before 11 a.m.

This is a fair way of fixing the interest rate since it is set by a panel of banks collectively and is seen as a global standard of interest rates.

There are basically two types of SIBOR-pegged loans:

- 1 month SIBOR-based home loan

- 3 month SIBOR-based home loan

FDR home loan

Fixed Deposit Based Rate is another type of floating home loan rate. FDR is based on banks’ fixed deposit interest rates along with a bank spread. The bank may change the interest rate on FDR loans at their own disposal provided they inform you well in advance.

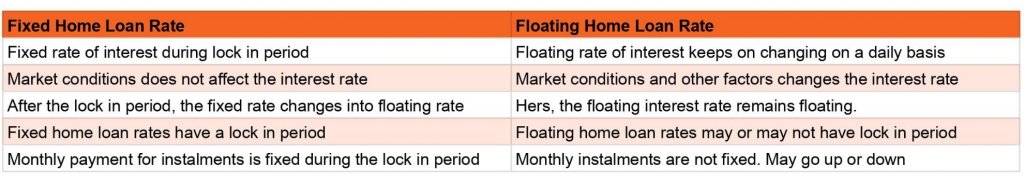

Difference between Fixed rate and Floating rate

Benefits of floating rate home loan

If you are someone who can monitor the SIBOR and FDR rates on a daily basis,and there are chances of a fall in the interest rate, then you should choose a floating home loan rate.

- Advantage of falling interest rate environment.

- Partial repayment without penalty during lock in period.

- The interest rate is set by the association, so it is fair.

- Cheaper than the fixed interest rate.

- FDR floating rate is more stable.

- Borrowers can benefit over the interest rate by taking advantage of FD deposits.

Best floating rate home loan in Singapore

Best SIBOR floating rate home loan

Floating rates are different for different property types: HDB flats, private properties and condos, refinancing, and under construction properties.

Find below the best floating interest rates offered by the banks:

Conclusion

When choosing a floating home loan rate, you should be prepared with the fluctuations and changes in the interest rate every month. Since the interest rates change every day, the monthly installments for each month will also be changing. Therefore, you cannot budget a fixed monthly payment for the home loan you have taken. But a plus point is that there are chances that the interest rate goes down. Also, there is a lot you can save by opting for a floating home loan rate.